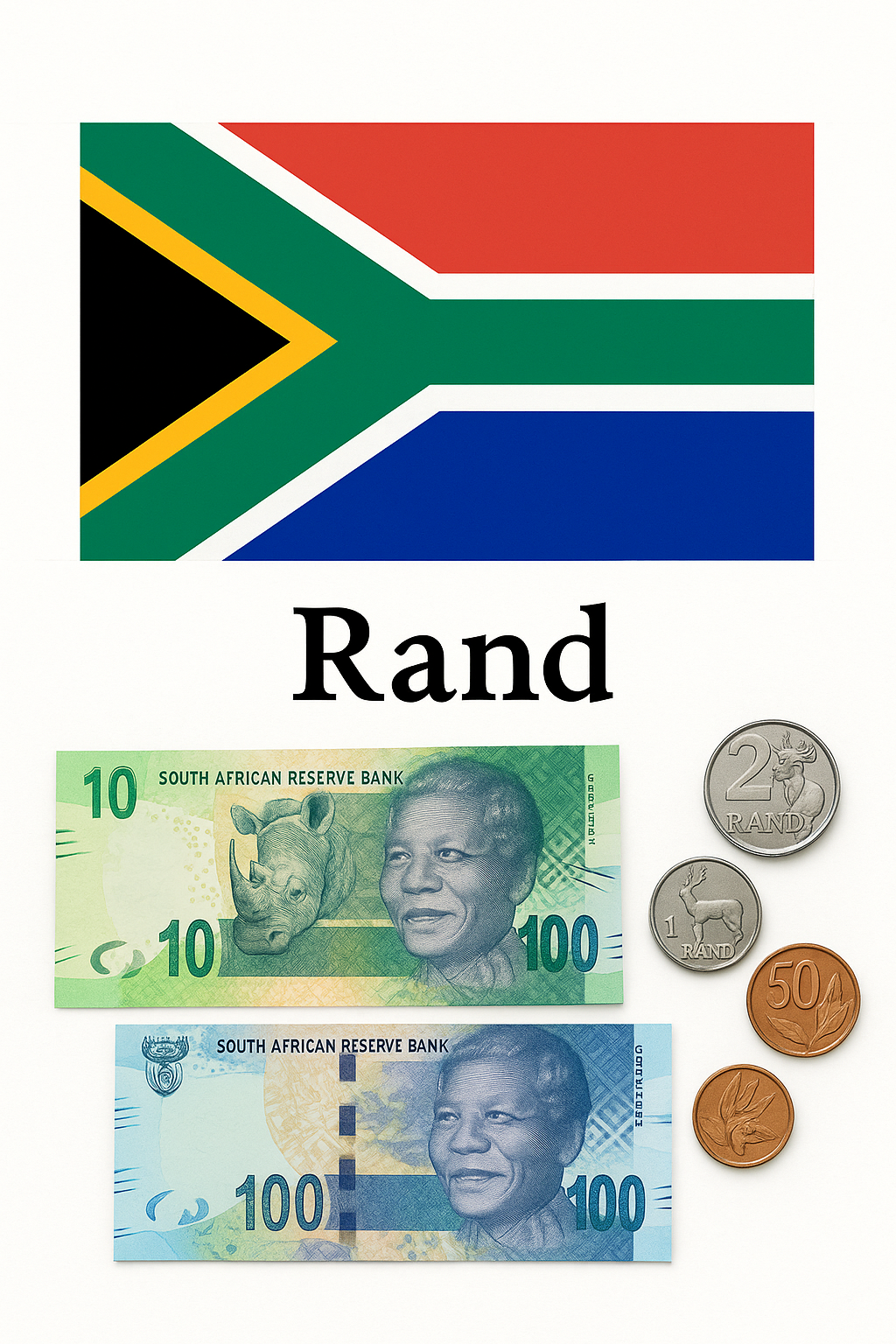

The South African rand clawed back ground to R18.70/$ ahead of today’s release of the SARB leading business cycle indicator, but the currency’s calm belies an acrid political fight over a 0.5 percentage point VAT hike due on 1 May that the opposition hopes to kill in court.

Market moves in a jittery April

The rand’s 0.3 % gain in early Johannesburg trade followed a fortnight of whipsaw moves that saw it weaken past R19/$ on 14 April before clawing back as traders marked down odds of the governing ANC pushing the tax hike through parliament intact.

At 09:05 SAST the three month implied volatility gauge sat at 16.4 %, well above the five year average of 12.8 %, underscoring how fiscal politics now steer currency risk more than cyclical data releases.

What the composite leading indicator shows and why it matters

The SARB’s leading indicator, due at 11:00 SAST, compiles ten forward looking series from passenger car sales to business confidence diffusion indices and historically leads real GDP by roughly six months. Economists surveyed by LSEG expect a modest uptick to 110.2 for February, after three monthly declines, helped by stronger money supply growth and a rebound in building plans passed.

If confirmed, that would translate into annualised GDP growth of about 1.6 % in Q3 2025 barely above population growth and well below the 3 % level National Treasury says is needed to stabilise debt.

The VAT battle that could crack the coalition

Finance Minister Enoch Godongwana’s February Budget added a half point to the VAT headline rate, lifting it to 15.5 %, to raise R29 billion in extra revenue. But the Democratic Alliance (DA) and Economic Freedom Fighters (EFF) partners in an uneasy confidence and supply pact with the ANC say the hike bypassed statutory public consultation rules and hurts the poor.

Their joint petition before the Western Cape High Court seeks an interdict blocking implementation until parliament votes separately on the measure. The bench fast tracked final arguments to 30 April, one day before the new rate is set to kick in.

Business, labour and the optics of reform

Organised labour federation COSATU normally an ANC ally has threatened a one day general strike if the tax goes ahead, while Business Unity South Africa warns that shelving the hike would punch a 0.4 % of GDP hole in the fiscal framework and could trigger ratings agency downgrades.

Currency desk traders say the impasse has already widened five year credit default swap spreads by 21 basis points since end March.

Bondcmarket barometer

South Africa’s benchmark 2030 government bond yielded 9.215 % on Tuesday morning, up nearly 50 bp since January; analysts at Rand Merchant Bank calculate every 100 bp jump adds R8 billion to debt‑service costs over 12 months.

Scenarios

- VAT upheld, indicator rebounds – The rand could test R18.20/$ as investors price in fiscal consolidation.

- Court blocks VAT, indicator disappoints – A break above R19/$ becomes likely, with bond outflows of R12‑15 billion in May.

- Compromise: delayed hike – Limited market relief, but political stability preserved.

Bottom line

The rand’s latest bounce masks deep fiscal fragilities. Unless Pretoria clarifies its tax plan and growth outlook, currency and bond markets will keep extracting a volatility premium.